The union representing workers at Akron Metro RTA has been without a contract for more than 17 months, and Rep. Emilia Sykes, whose district includes the city, is calling on both sides come to an agreement.

Latest Headlines

- The Justice Department has now sued 18 states in an effort to access voter data

- Akron police headquarters update: city to renovate Stubbs center Downtown

- Maltz Museum exhibit spotlights migrant struggles on the U.S.-Mexico border

- Trump touts his peace deals - but many are already unraveling

- U.S. military members fear personal legal blowback tied to boat strikes

Editors' Picks

A recent report from the federal monitor tracking that consent degree progress says Black drivers are disproportionately stopped by Cleveland police. Is it a sign of bias? The city says an outside firm conducted a study last year and found no bias.

-

Gov. Mike DeWine has said he’ll fully expects to endorse the Republican candidate for Ohio governor next year—but hasn't so far.

-

The herbal extract from Asia has naturally occurring trace amounts of the alkaloids mitragynine and 7-hydroxymitragynine, which in high doses have sedative effects.

-

The executive order is the latest in a series of attempts by the Trump administration to hold back state-level AI rules. But many Republicans are also uncomfortable with the effort.

-

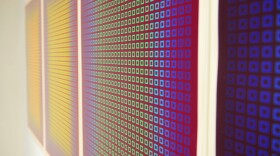

Sculptures, paintings, photographs and more are on view at the Bostwick gallery Downtown

-

The program that subsidizes housing is losing funds due to cuts in the Cuyahoga County budget.

-

A worker’s demotion after releasing court records to The Marshall Project - Cleveland led to a lawsuit alleging retaliation and witness intimidation.

-

Cleveland-bred musician Machine Gun Kelly is pitching in a quarter of a million dollars to fund a skate park on the city's Southeast Side.

-

MetroHealth System says nearly half of the serious injuries it treats in winter come from people slipping and falling on icy or uneven surfaces, a risk that’s especially dangerous for older adults.

-

Bernabei is being remembered for serving as mayor for eight years and supporting various organizations across the county.