This Election Day, Akron voters are being asked to consider Issue 4, a quarter-percent income tax increase. It would be the first such increase in a generation.

In February, 1981, Roy Ray was capping his first year as mayor of Akron with a narrowly approved income-tax increase. The extra money was for “essential city services:" police, fire and roads.

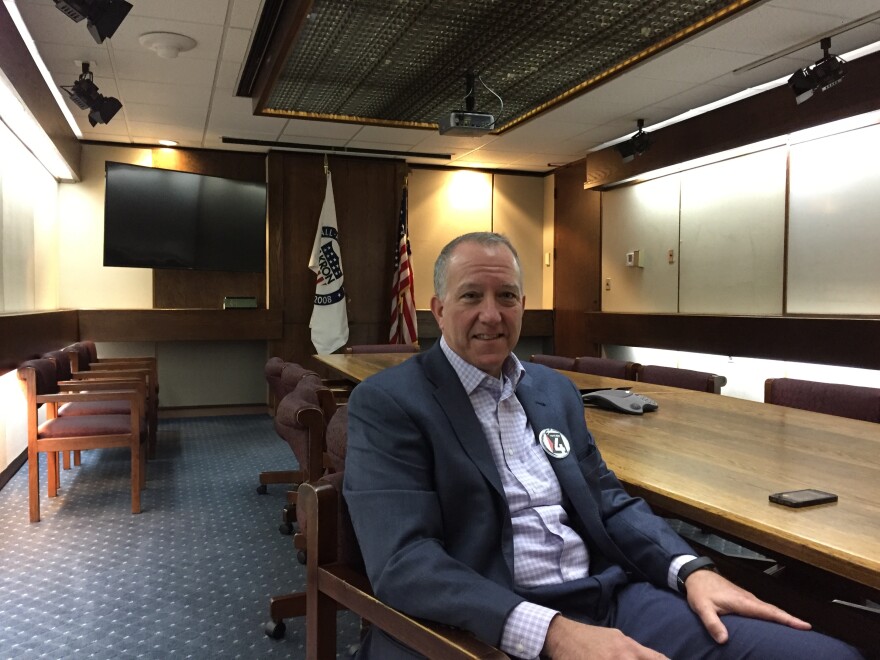

Back then, Akron’s current mayor, Dan Horrigan, was in high school.

“I never wanted to come in and say, ‘Hey, let’s raise taxes.’ But given the fact that we haven’t done it for that long.”

He says the city has done its part to tighten its belt.

“We’ve been efficient by cutting our workforce in half since 1981. I think we’ve been very good stewards of the public dollar.”

In the 36 years since, voters have approved a tax hike that included schools, but never another one for basic services. That could change next week with Issue 4, which would put the income tax rate on par with Cleveland and Columbus, going from 2.25 to 2.5 percent. The money is earmarked exclusively for police, fire and roads. Horrigan says that’s because public safety is a top priority, and things like fire stations are being used far beyond their intended capabilities.

"They were built for 2- and 4-ton trucks; the average (today) is like 10-ton trucks. So we have these steel supports that are literally -- we used to build them with the garages or basements underneath -- so we have these supports that are holding up, literally, the floors.

"I don't think it's a fair way to be able to fund the police and fire and public safety to do that. I think we have 150 police cars with over 100,000 miles. We just have not been able to replace those in a more responsible manner."

Paying for new technology

Along with cruisers, the entire police force has to pay for something new that didn’t even exist back in 1981 – digital video storage.

“It’ll be about $300,000 a year to store body-worn camera videos each and every year. That’s an ongoing expense.”

Horrigan has been sporting a large “Yes on 4” button since proposing the increase in June and says he’s gotten a lot of positive feedback for the tax hike. Community activist Sage Lewis – who works mostly on issues related to the homeless community – says he’s all-in for Issue 4 for a few reasons.

“I believe that a lot of people that are coming into the city to work are going to be affected by this. People who are using the city during the day -- they’re benefiting from these services. So I think the income-tax approach is ideal. I believe that for low-income people, this is going to be very negligible. This is a very small percentage of a percent.”

What will it cost?

The city estimates that the average annual salary in Akron is $35,000, so the tax increase would work out to

$6.72 a month. But that can still be a lot for some families struggling with high water and sewer bills, according to Councilman Zack Milkovich. He opposes the increase, saying the city could tighten its belt by doing things like getting rid of city cell phones, or even some of its deputy mayors.

He’s one of three city councilmen who voted “no” on a recent resolution endorsing the increase. Another “no” vote was Councilman Russ Neal, who says he’s for the increase but wants to know more about how it will be spent.

“My concern is, we’re going into it and we don’t have an understanding of what it would cost to do those things." Also, he ssays, "the message is going out right now -- is that these funds are going to be restricted for police, roads and fire.”

Neal says there are other needs that he’d like to see considered, with input from the public.

“A lot of the community parks are having the recreation equipment pulled out of them because it no longer meets the safety requirement specs. Those little quality-of-life things in the community are being pulled. I chair Parks and Rec; if you go to our Balch Street Community Center – which is our premiere recreation center -- the pool is shut down right now because it’s being repaired because there’s a crack that goes from side-to-side.”

The road ahead

Still, City Council was unanimous in its approval of placing the measure on this fall’s ballot and letting the people decide. Community activist Sage Lewis points to one issue that affects most people in Akron.

“Our roads are a nightmare. Just watch how many potholes are going to develop this winter and not get filled. It’s not because they hate us; it’s because they don’t have the money! It’s simple! It’s simple, simple math.”

That’s why Horrigan says he’s earmarked one-third of the projected $16 million take from the tax hike to go toward roads.

“We've done a study on the streets, back in 2015. And we know exactly which ones are in the worst condition and which ones are pretty good. So we can literally take that off the shelf and start with the worst roads right away and get them.”

Horrigan says the city could pave an additional 42 miles of roadway each year if the tax hike passes.